Azerbaijan is one of only a few countries — including three former Soviet republics (Uzbekistan, Turkmenistan, and Belarus) — that are not members of the World Trade Organization (WTO). Because the benefits of WTO membership warrant a separate study, this analysis does not delve into that issue. It is enough to note that over the past 30 years the Azerbaijani government has not only avoided WTO membership with various excuses but has also sought to convince public opinion that regional trade agreements better serve the country’s interests under current conditions.

Since 1992, Azerbaijan has signed similar agreements with all member states of the Commonwealth of Independent States (CIS) except Armenia, with which it has been at war. Under these bilateral free trade agreements, goods imported directly from one country's customs territory into another are exempt from import duties, and the same exemption applies to goods traded under preferential certificates of origin. [1]

In 2020, Azerbaijan and Türkiye signed a preferential trade agreement granting mutual benefits. [2]

The main objective now is to assess the role these free trade agreements have played in shaping Azerbaijan's foreign trade, based on an analysis of statistics spanning at least the past 20 years.

Content of free trade agreements with CIS countries

Although not all the texts of the agreements with CIS countries are available to the public on the official legislative portal (e-qanun.az), the content of similar documents signed with some countries provides insight into the mutual rights and obligations related to free trade. However, the protocols that form part of these agreements are almost never disclosed.

As an example, the bilateral free trade agreement signed with Belarus in September 2004 illustrates that similar documents typically include the following provisions [3]:

- Both countries apply a free trade regime to mutual trade in goods in accordance with the provisions of the agreement.

- The parties do not impose customs duties, taxes, or charges with an equivalent effect on the export and import of goods covered by mutual trade.

- If necessary, exceptions to the trade regime may be introduced for specific goods, formalized and agreed upon through protocols that are part of the agreement.

- The parties will either refrain from imposing taxes and duties on goods covered by this agreement or ensure that any applicable taxes and duties do not exceed those imposed on similar goods originating from third countries.

- No special restrictions, requirements, discriminatory measures, or quantitative limitations will be applied to the import and export of goods covered by the agreement.

- The parties will not impose different regulations on the warehousing, loading, storage, transportation, or payment of traded goods than those applied to goods from third countries.

- The parties will prevent the unauthorized re-export of goods from their territories through the application of tariff and non-tariff regulation measures.

The agreements signed with other CIS countries, including Georgia, contain largely similar provisions.

The structure and volume of Azerbaijan's trade with CIS countries

The impact of bilateral free trade agreements with CIS countries on Azerbaijan’s foreign trade volume and structure can be clearly observed in the data provided by official trade statistics. [4]

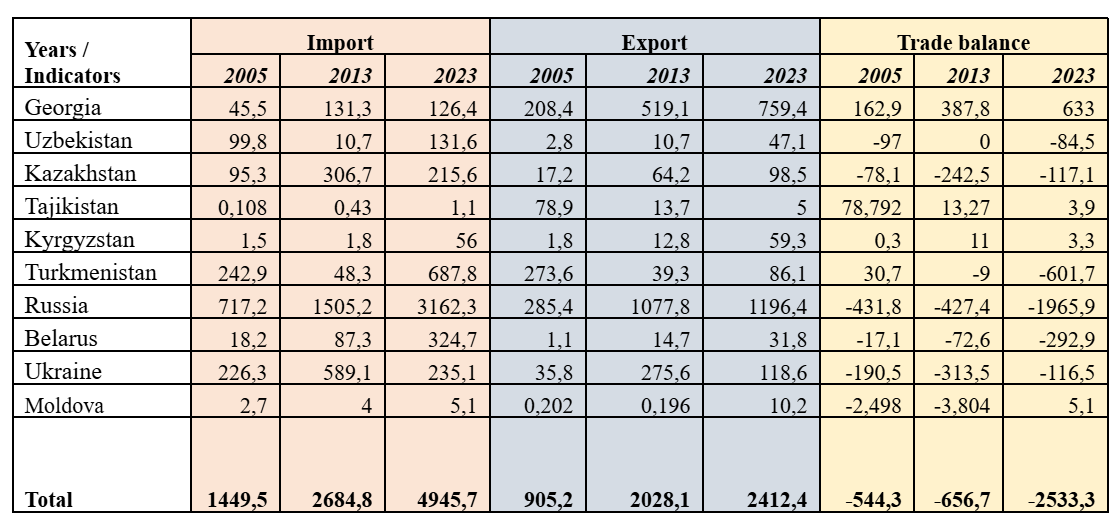

Trade turnover between Azerbaijan and CIS countries & Georgia (2005–2023), in million USD (Table. 1)

Note: Since Georgia was a member of the CIS at the time it signed a bilateral free trade agreement with Azerbaijan (1996), its foreign trade turnover with Azerbaijan is presented as part of the total CIS figures in this analysis, without separation.

The key takeaway from the presented figures is that between 2005 and 2023, Azerbaijan's total imports from these countries grew at a significantly higher rate than its exports to them. The most significant increase in import volume occurred between 2013 and 2023. While imports from the CIS grew by $1.235 billion in 2005–2013, they surged by $2.685 billion in 2013–2023. Overall, import volumes increased 3.4 times between 2005 and 2023. In contrast, total exports to CIS countries grew 2.7 times, or by nearly $1.5 billion, over the same period. Compared to imports, the growth rate of exports was higher in 2005–2013 ($1.122 billion or 124%) but slowed in 2013–2023 ($384 million or 19%).

Russia's trade presence in Azerbaijan has expanded quickly

Another negative trend observed during the analyzed period is the sharp increase in Azerbaijan’s trade deficit with the CIS. While the deficit remained below $660 million between 2005 and 2013, by 2023, it had surpassed $2.5 billion.

Russia holds the dominant position in Azerbaijan’s trade within the CIS, and over the past 18 years, trade turnover between the two countries has steadily grown. However, Russia has benefited significantly more from this expansion, as the figures clearly show. Between 2005 and 2023, Azerbaijan’s imports from Russia grew by $2.5 billion, whereas its exports to Russia increased by just over $900 million.

From 2013 to 2023, the growth of Azerbaijani exports almost stagnated. Over the past 10 years, exports increased by only 11% (or $118 million), while imports from Russia more than doubled, rising by nearly $1.7 billion.

In 2023, 64% of Azerbaijan's total imports from the CIS and 49.5% of its total exports to this region were accounted for by Russia. During this period, the trade deficit with Russia reached nearly 2 billion dollars. As seen, small Azerbaijan plays a larger market role for Russia than the giant Russia does for Azerbaijan.

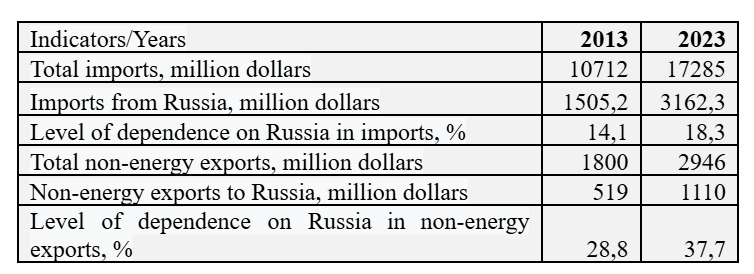

Another sharply negative trend in Azerbaijan’s bilateral trade with Russia is the growing dependence on both imports and non-energy exports. This also shows that instead of diversifying non-energy exports into developed markets, Azerbaijan is further expanding them within Russia’s sphere of influence. (Table. 2)

The calculations based on the official figures in the table show that between 2013 and 2023, Azerbaijan's dependence on Russia rose from 14.1% to 18.3% for imports, and from 28.8% to 37.7% for exports of non-energy products.

Undoubtedly, a high level of trade dependence on a country like Russia—known for its erratic and aggressive policies toward its neighbors and expected to face significant economic decline in the medium and long term—is inefficient. Moreover, Russia’s pursuit of a dominant position in bilateral trade with regional countries is driven more by political ambitions than economic benefits. In particular, the less integrated small and weak economies are into the global economic system, and the more they rely on Russia for trade, the easier it is for Russia to keep them within its sphere of political influence.

Another noteworthy trend in these statistics is that as Azerbaijan’s trade with Russia has grown, its trade with Ukraine has declined. For example, between 2005 and 2013, Azerbaijan's exports to Ukraine increased more than sevenfold, rising from $36 million to $276 million, and imports grew by nearly 2.5 times, from $226 million to $589 million. However, the situation has reversed in the past 10 years – from 2013 to 2023, exports to Ukraine fell from $276 million to $119 million, while imports from Ukraine dropped from $589 million to $235 million.

During the analyzed period, trade with Belarus also grew significantly. Between 2013 and 2023, imports from Belarus surged nearly fourfold, rising from 87 million to 325 million. However, Azerbaijan’s exports to Belarus remained minimal in comparison. Even after doubling over the past decade, exports to Belarus totaled just 32 million—one-tenth of the import volume. As a result, Azerbaijan’s trade deficit with Belarus reached 293 million in 2023.

"Overall, Azerbaijan runs a trade deficit with all CIS countries, which together account for the largest share of its foreign trade. In 2023, for example, Azerbaijan had a negative trade balance with Russia, Belarus, and Turkmenistan—three countries that made up 75% of its total trade with CIS nations and Georgia. The only exception is Georgia, where Azerbaijan consistently maintains a trade surplus, primarily due to energy exports.

In 2023, Azerbaijan’s exports to Georgia totaled $759 million, while imports from Georgia amounted to $126 million, resulting in a trade surplus of $633 million. Energy products made up $548 million (72%) of these exports, including $121 million from electricity sales.

Meanwhile, Azerbaijan’s trade with Kazakhstan and Uzbekistan—two countries with significant demographic and economic potential—remains relatively limited. Moreover, Azerbaijan runs a trade deficit with both. In 2023, total exports to these two countries reached $145.6 million, while the trade deficit stood at $84.5 million with Uzbekistan and $117 million with Kazakhstan."

The framework of the preferential trade agreement with Türkiye

The preferential trade agreement signed between Azerbaijan and Türkiye in May 2020 provides for duty-free and tax-free mutual trade for goods specified in the annexes to the agreement. Both countries are expected to benefit equally from this arrangement.

Under the agreement, Azerbaijan and Türkiye will grant each other a trade regime no less favorable than that granted to any other country in terms of all rules, regulations, and procedures governing foreign trade. However, the bilateral agreement should also account for the tariff quotas or concessions that each country has separately established for other nations.

The goods specified in the annex to the agreement must be of local origin. The following goods qualify as local:

- Raw materials and mineral products extracted from the land, waters, or seabed of the countries party to the Agreement;

- Agricultural products grown, harvested, or collected within their territory, including forestry products, as well as live animals born and raised there, along with products derived from these animals;

- Products obtained through hunting, fishing, and marine harvesting activities conducted in these countries, as well as marine fishery products caught beyond their territorial waters by their vessels.

Additionally, under the agreement, the following approach is applied to processed products: If the value of third-country materials used in the production of traded processed goods does not exceed 45% of the ex-works price of the final product, these materials are considered to have undergone sufficient processing or transformation.

However, operations such as packaging, labeling, sorting, textile finishing or pressing, simple dyeing, animal slaughter, and similar processes do not qualify as sufficient and cannot be used to establish a product as of local origin.

Along with the raw materials and components used, one of the key criteria for determining local origin is the location where the process requiring specialized skills, machinery, equipment, or tools is carried out. If these operations occur in a third country, the product is not considered of local origin and is ineligible for the benefits provided under the Agreement.

Finally, under the agreement, the energy and fuel used in the production of the final product, as well as facilities, equipment, machinery, and tools, are considered neutral elements and are not taken into account when determining the country of origin of the goods.

The bilateral preferential agreement signed between Türkiye and Azerbaijan also includes a number of safeguard, phytosanitary, anti-dumping, and compensatory measures. The most important of these measures are as follows:

- To prevent damage caused by dumping or subsidies, both countries apply anti-dumping and compensatory measures in accordance with their national legislation.

- If the reduction or elimination of tariffs by mutual agreement leads to an increase in imports that causes serious harm to the domestic industry producing competitive goods in either country, bilateral safeguard measures may be applied after consultations.

- Sanitary and phytosanitary measures are based on scientific principles and are applied only to the extent necessary to protect human, animal, or plant life and health. These measures are not maintained without sufficient evidence, considering available scientific data and regional conditions.

The annexes to the agreement specify 15 types of goods for each country, and the provisions of the agreement apply exclusively to these goods. The list of these goods and the designated import quotas for each are presented in the statistical analysis section below.

Preliminary statistical results of the Azerbaijan -Türkiye Preferential Agreement

For many years, Türkiye has been one of Azerbaijan’s three largest trading partners, alongside Italy and Russia. According to the Customs Committee, in 2023, approximately 55% of Azerbaijan’s foreign trade turnover was accounted for by these three countries, including 31% with Italy, 15.5% with Türkiye, and 8.2% with Russia. [5]

During the same period, Azerbaijan’s imports from Türkiye amounted to $5.4 billion (out of a total national import value of $17.3 billion), while exports to Türkiye totaled $2.3 billion (out of a total national export value of $33.9 billion). In 2023, nearly 95% of Azerbaijan’s exports to Türkiye — equivalent to $4.9 billion — consisted of energy products, including $276 million worth of electricity.

In May 2020, the governments of both countries stated that the purpose of signing the preferential trade agreement was to further expand bilateral trade turnover. Has official statistics recorded progress toward this goal in the four years since the agreement was signed?

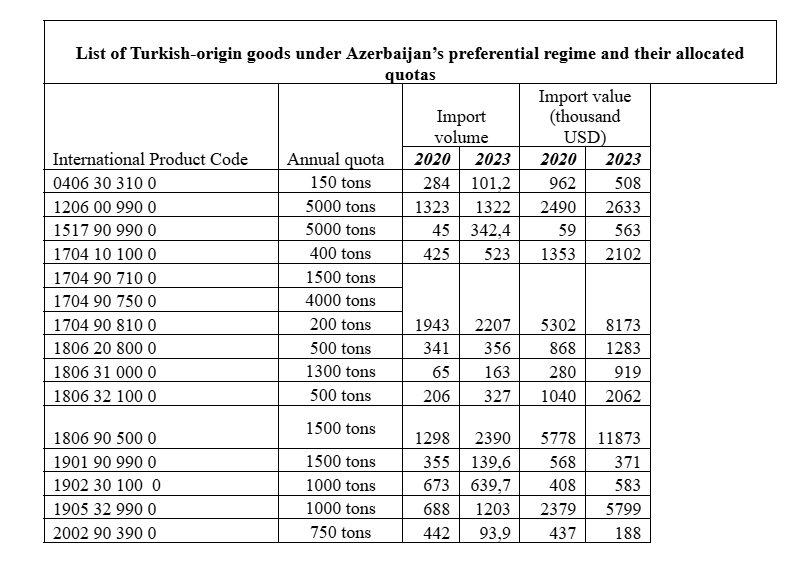

Most importantly, has there been an increase in the trade turnover of goods covered by the preferential tariff regime under the agreement? The following tables, compiled based on official figures, provide answers to these questions. (Table. 3)

Under the agreement, Azerbaijan committed to granting a full tariff exemption on 15 goods imported from Türkiye. An annual quota has been set for each item on the concession list, and imports exceeding the quota will not benefit from the exemption, instead being subject to standard tariffs. An analysis of official statistical data shows that in the three years following the agreement, Türkiye increased its exports of these goods by 69%, or 16 million dollars, reaching a total of 37 million dollars.

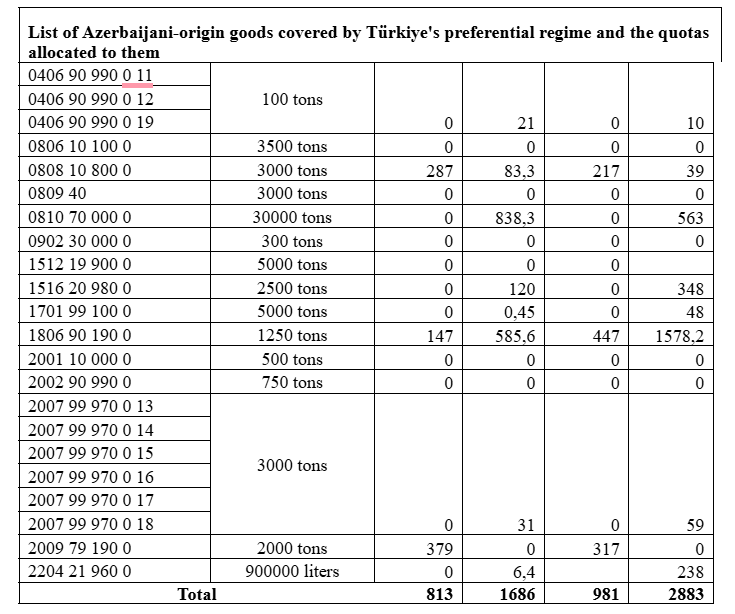

Regarding Azerbaijan's use of the tariff exemptions granted by Türkiye during this period, it is important to note that Azerbaijan also secured the same privileges, allowing it to export 15 goods to Türkiye free of taxes and duties. (Table. 4)

Statistical comparisons show that, although the preferential regime covers the same number of goods, Azerbaijan's export volume within this framework is approximately 13 times smaller than Türkiye's. While Azerbaijan's exports have grown faster since the agreement was signed, Türkiye's export volume remains significantly larger in statistical terms. However, when considering the total exports of both countries, exports under the preferential regime are minimal, accounting for less than 0.1% of their total exports. Moreover, preferential trade represents only 0.5% of the total bilateral trade turnover between Türkiye and Azerbaijan.

Some interesting conclusions from the analysis

- Over the past nearly 20 years, the countries that have partnered with Azerbaijan in free trade agreements with the CIS have benefited more. This is reflected in the fact that between 2005 and 2023, Azerbaijan's trade deficit within the CIS trading area more than doubled, as the country's import growth significantly outpaced its export growth.

- Azerbaijan's foreign trade with Russia has consistently expanded, with this growth accelerating over the last decade. As a result, Russia has emerged as the primary beneficiary. From 2013 to 2023, the growth of Azerbaijan's exports significantly slowed. Over the past 10 years, Azerbaijan's exports grew by only 11%, or 118 million dollars, while imports from Russia more than doubled, increasing by nearly 1.7 billion dollars. Consequently, Azerbaijan, a smaller country than Russia, has become an important market for Russia.

- Alongside its trade with Russia, Azerbaijan's foreign trade turnover with Belarus has also grown. Between 2013 and 2023, imports from Belarus nearly quadrupled, reaching 325 million dollars. In contrast, Azerbaijan's exports to Belarus remain very low; even after doubling over the past 10 years, exports to Belarus totaled only 32 million dollars, which is 10 times less than imports from that country.

- During the rapid expansion of Azerbaijan's foreign trade relations within the framework of its political alliance with Russia and Belarus, trade with Ukraine became increasingly limited. From 2005 to 2013, Azerbaijan's exports to Ukraine increased more than sevenfold, reaching $276 million, while imports grew nearly 2.5 times, totaling $589 million. In contrast, over the past 10 years (2013–2023), the trend reversed: exports to Ukraine dropped from $276 million to $119 million, and imports from Ukraine declined from $589 million to $235 million.

- The benefits derived from the bilateral preferential trade agreement with Türkiye remain relatively low for both countries.

Endnotes

[1] “Regional Ticarət Sazişləri - Azərbaycan Və Ümumdünya Ticarət Təşkilatı.” https://wto.az/saheler/regional-ticaret-sazishleri.

[2] “E-QANUN.” https://e-qanun.az/framework/45319.

[3] “E-QANUN.” https://e-qanun.az/framework/5744.

[4] “Ticarət | Azərbaycan Respublikasının Dövlət Statistika Komitəsi.” Azərbaycan Respublikasının Dövlət Statistika Komitəsi. https://www.stat.gov.az/source/trade/.

[5] Azərbaycan Respublikası Dövlət Gömrük Komitəsi. 2023. “Azərbaycan Respublikası Xarici Ticarətinin Gömrük Statistikası Hesabat Dövrü: 01.01.2023 – 31.12.2023.” Azərbaycan Respublikası Dövlət Gömrük Komitəsi. Accessed April 18, 2025. https://customs.gov.az/uploads/foreign/2023/2023_12.pdf?v=1705581222.